Company Overview

🚀 Future Growth Bets

🤖 Tesla Optimus

- Humanoid robotics could become a 24T market by 2050 (Morgan Stanley, Citigroup, ARK).

- Elon Musk aims for 1M units/year by 2030 at <$20K per unit.

- Potential internal usage by end of 2025, major revenue upside.

- Risks: Management turnover, production delays, strong Chinese competition.

- Quote: “Tesla could eventually generate more than $10 trillion in revenue.” — Elon Musk

🚕 Tesla Robotaxi

- ARK: Could be 90% of Tesla’s enterprise value by 2029.

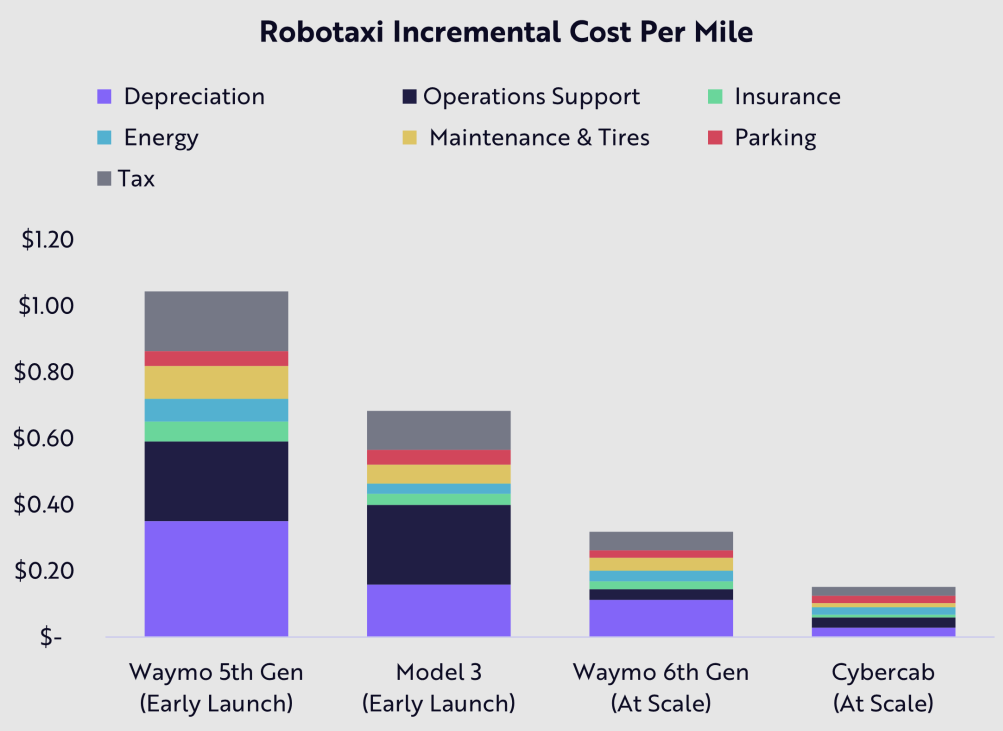

- Tesla’s cost/mile could be 30–40% lower than Waymo due to vertical integration (no LiDAR, etc).

- Waymo currently leads with 1M+ paid robotaxi rides/month.

Interesting Stats & News

https://seekingalpha.com/article/4799562-teslas-austin-fsd-rollout-autonomy-bet-is-failing

- Yet to summarise the points here

Could this be the best reason to buy Tesla stock hand over fist? (Hint: It’s not robotaxis.) | July 8 2025 | By: Keith Speights from The Motley Fool

📉 Current Valuation

- Tesla stock remains ~34% below its all-time high — creating a potentially attractive entry point for long-term investors.

🚕 Robotaxi Hype – Caution Advised

- Ark Invest projects a $4T market by 2030, positioning Tesla as the dominant player.

- However, mainstream estimates (e.g., Fortune Business Insights) suggest a much smaller market (~125B by 2030–2034).

Robotaxi thesis is still highly speculative and varies wildly by source.

🤖 Bigger Opportunity: Humanoid Robots (Tesla Optimus)

- Market size by 2050:

- Morgan Stanley: $5T

- Citigroup: $7T

- Ark Invest: $24T

- Use cases: domestic labor, elderly care, repetitive factory tasks

- Tesla Optimus seen as a front-runner.

📦 Tesla’s Ambition with Optimus

- Elon Musk targets 1M Optimus units/year by 2030, priced under $20K.

- Thousands of Optimus expected to work in Tesla factories by end of 2025.

- Musk hinted at potential for >$10T in revenue from Optimus over time.

⚠️ Risks and Caveats

- Internal challenges (management changes, delays) with the Optimus program.

- Rising global competition, particularly from China.

- Market opportunity is long-term (2030s–2050), not near-term.

Bottom Line

If Tesla succeeds in mass-producing an affordable, general-purpose humanoid robot by 2030, Optimus—not robotaxis—could be the biggest growth driver for the company in the next decade. While the upside is massive, investors must account for execution risk and long timelines.

Robotaxi wars: Waymo is the early leader, while Tesla may end up having lower costs per mile | June 16 2025 | By: Seeking Alpha News Editor

🏁 Market Leader: Waymo (for now) • Waymo currently leads the robotaxi space with 1M+ paid rides/month across Phoenix, SF, LA, and Austin. • Real-world operational advantage gives Waymo early mover credibility and data scale.

🚘 Tesla’s Long Game • ARK Invest believes Tesla’s robotaxi platform will transform its business model from hardware sales to a recurring, high-margin software platform. • By 2029, the platform could represent ~90% of Tesla’s enterprise value. • Tesla’s vertically integrated approach (no LiDAR, no dependency on third parties) could yield 30–40% lower per-mile costs than Waymo at scale.

Summary Insight

Waymo holds the operational lead today, but Tesla may win on cost-efficiency and scale over time. The robotaxi opportunity could become the dominant value driver for Tesla if it executes, though competition and regulation remain key risks.

Source: Ark Invest

Source: Ark Invest